DASH cryptocurrency is suitable for both investment and speculative purposes. At the beginning of its history, mining was the main way to obtain crypto.

Nowadays, apart from mining, there are other methods of obtaining coins – numerous exchanges and exchangers.

DASH Cryptocurrency

Exchanges

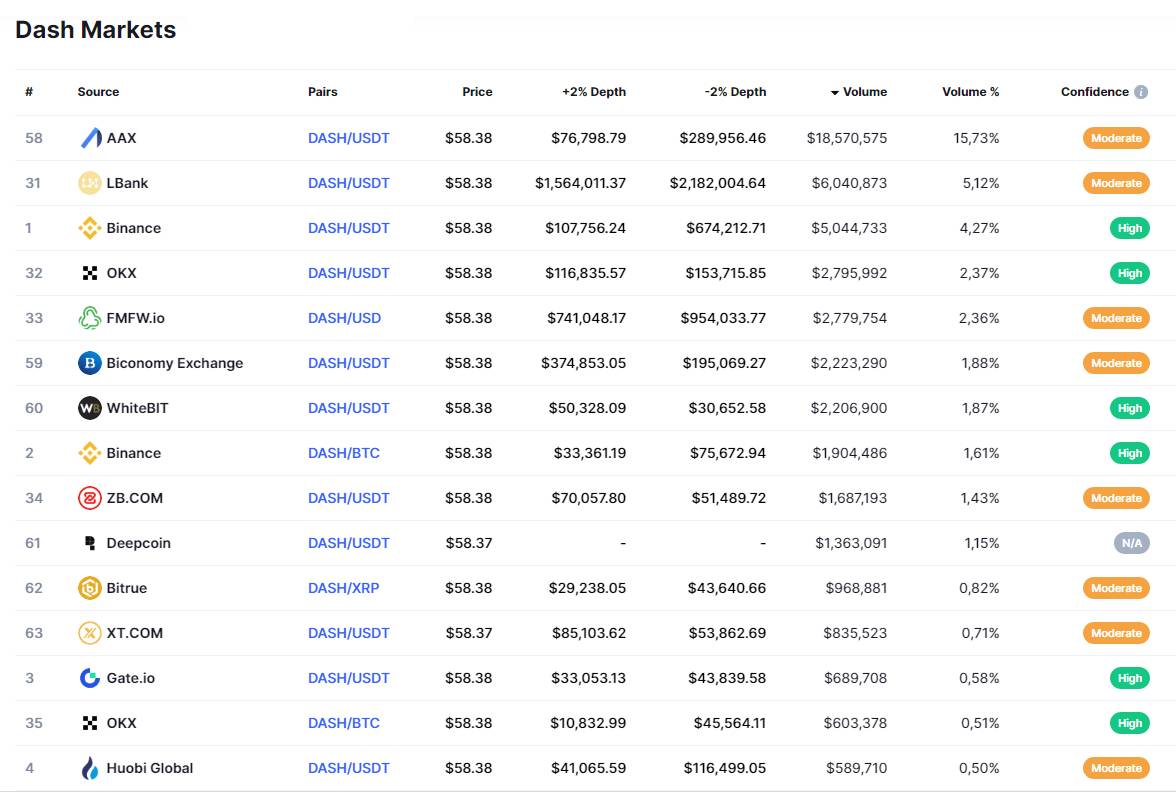

Now this cryptocurrency is quite popular and the listing phase on major exchanges has long passed. Now DASH (you can read the history of cryptocurrency here) is traded not only on major cryptocurrency exchanges, but also on all more or less major platforms. The greatest activity is observed on AAX, LBank, Binance.

As for buying on the exchange, you can buy tokens for both fiat and other cryptocurrencies. It only depends on whether the crypto exchange, where you plan to buy, supports fiat currency or only electronic money.

To Purchase Crypto

- The volume of the transaction is set.

- Selects the order type (limit or market).

- Selects the direction of trade – buying or selling crypto.

For large volumes, it is better to choose exchanges with maximum DASH turnover. You will have less to wait for the right counter volume and your order will be executed.

Maximum profitable rate of cryptocurrency you can get specifically on the cryptocurrency exchange.

Exchangers

Exchanger services are convenient because they do not require complex verification, and they work with both crypto and fiat. Today there are dozens of online exchangers working in the DASH-fiat direction.

To find the best exchange rate for buying cryptocurrencies, we recommend using aggregator websites, where data from all exchangers, registered on them, is stacked.

The exchange itself takes only a few minutes:

- The buyer transfers fiat to the requisites of the exchanger.

- The exchanger service, after receiving fiat currency, sends the crypto to the buyer’s wallet.

- Since, in case of DASH, you don’t have to wait long for transaction confirmation, very quickly the coins will appear in your wallet.

Of the disadvantages of this option is an unfavorable rate in a number of directions.

DASH Exchange Rate

The current rate of Dash to the dollar, Bitcoin and Ethereum.

The cryptocurrency peaked in popularity in December 2017. At that time, the value of the token reached $1550. This was followed by a 20-fold collapse in value. The same with the capitalization, at the peak this indicator reached $12 billion. At the time of writing, the rate of DASH is $58 and the capitalization is about $1.1 billion.

The reason for the high volatility is not because of problems with the crypto itself or the unpromising nature of the project, but because of the overall situation with cryptocurrencies in the world. It should be noted that the coin’s trading volume has been high lately, so the interest in DASH hasn’t gone anywhere.

What Can You Spend it On?

Crypto can be used as a secure way to transfer money anywhere in the world where internet access is available. In addition, more and more online stores, and other services support DASH as payment for their goods and services.

Cryptocurrency is used to pay for hotel reservations, to pay for dinners at restaurants, to buy electronics and clothes at online stores.

If you have DASH coins and there are no stores in your city that support them as a means of payment for purchases, try to find the right product in online stores. The price can be even better than in fiat.

1. Weak points of the DASH coin

There are no perfect crypto projects, and DASH is no exception. Let’s highlight the main disadvantages:

- The possibility of de-anonymization. PrivateSend is one version of the CoinJoin technology implementation, and provides for merging transactions. Theoretically, it is possible to track recipients simply by tracking these merges. So there is no 100% anonymity in DASH. New addresses are constantly being added to the mix, it’s hard to track the recipients, but it’s possible.

- Another possibility for de-anonymization arises from another CoinJoin implementation, where a party that knows the sender is involved. Let’s look at the example. A user uses CoinJoin technology on a wallet with a balance of 1.2 DASH, the wallet has 0.2 DASH remaining, and 1 DASH is involved in CoinJoin. Out of that amount 0.7 DASH is spent anonymously, and 0.3 DASH goes to a known party, like a cryptocurrency exchange or an exchanger. And the balance, which went to a known party, can be used to trace the sender of the crypto, and CoinJoin doesn’t help in this situation.

- The third method of de-anonymization is also to trace the real owner of the crypto through a known source connection. The scheme is taken from the DASH cryptocurrency whitepaper. A user buys 1.2 on Coinbase. He then uses 1 DASH in CoinJoin, leaving a balance of 0.2 DASH. Anonymously he sends 0.7 DASH, and 0.3 DASH returns to the wallet, so it is 0.5 DASH in total. To find out who the User really is, you can simply trace the origin of those 0.2 DASH.

Wrapping Up

Note that all methods to de-anonymize DASH cryptocurrency are complicated and if you are not breaking the law, then it is unlikely that someone will specifically hunt for you.

And finally – if you are worried about the anonymity of your transfers – DASH anonymity is still higher than Bitcoin, Ethereum and other top cryptocurrencies.

You May Like To Read:

- Which Cryptocurrency is Better to Invest Nowadays?

- 3 Best Ways To Invest Money in Cryptocurrency

- What’s the Scope for Careers in Blockchain Technology & Cryptocurrency?

Author: Jamie Martinez